HOW A FLEDGLING GARDEN STATE BANK LAUNCHED IN 1989 HAS BECOME A BILLION DOLLAR ENTERPRISE

BY JESSICA JONES-GORMAN • PHOTOS BY AMESSÉ PHOTOGRAPHY

1st Constitution Bank was founded in 1989, and within a short time, the fledgling financial institution had three branch banking offices and $75 million in assets. Today, almost three decades later, 1st Constitution Bancorp is a diversified financial services holding company and the parent company of 1st Constitution Bank, with more than $1 billion in assets. The company operates 18 branch banking offices along with several satellite facilities, and has consistently maintained a strong commitment to families, small businesses, and midsize companies.

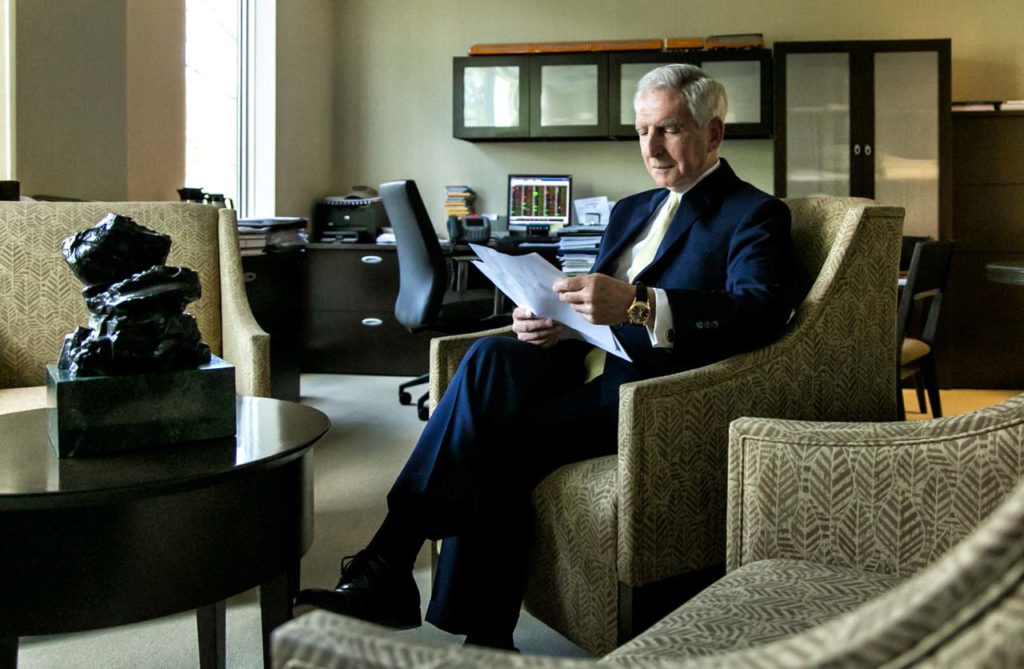

“1st Constitution was formed by a small group of local businesspeople with the vision and goal to establish a community bank dedicated to a positive customer experience and a commitment to enhance shareholder value,” noted Robert F. Mangano, president and chief executive officer of 1st

Constitution. “In structure and strategy, it was not much different than a number of other community banks that were organized at the time. But today, almost 30 years later, we are still here and thriving.”

Recognized for its financial performance, prudent risk management, and use of technology, the bank provides a wide range of services. Headquartered in Cranbury, New Jersey, it operates 18 branch offices around the state in Cranbury (2), Fort Lee, Hamilton, Hightstown, Hillsborough, Hopewell, Jamesburg, Lawrenceville, Perth Amboy, Plainsboro, Rocky Hill, Princeton, Rumson, Fair Haven, Shrewsbury, Little Silver, and Asbury Park.

“Our strategy has been to create a more diverse institution than the typical community bank,” Mangano said, “with a primary focus on the consumer and small business.” On the bank’s consumer side, management has built a residential mortgage origination business to address the growth in the New Jersey housing market. It offers home equity products in addition to a group of state-of-the-art deposit products. On the business side, the company has assembled a number of experienced lending officers who operate several specialty and traditional lines of business. These services include traditional commercial lending and commercial mortgage products.

The company also operates an active construction lending unit focused on financing builders constructing single-family homes, town homes, and condominium developments. 1st Constitution also has a full-service small business lending function through the U.S. Small Business Administration, where it maintains a preferred lender status. It is also one of just two commercial banks in New Jersey offering mortgage warehouse lines of credit, which provide financing to mortgage bankers primarily located in the state. Each of these businesses is vertical, meaning that it is headed by a single individual with a wealth of pertinent experience, instead of relying on anyone from the outside to deliver services.

“Banking is a people business, and I like working with people,” Mangano noted. “Our staff is truly the key to our success. A large portion of our senior management team has been with the bank between 10 and 15 years; they know our customers personally, answer their telephones, and react quickly to each of our client’s requests. Ask any community bank president and they will state that personal service is a high priority. Still, saying it and doing it are two different things. We work at it every day and try to view each opportunity from the customer’s point of view.”

On the deposit side of the bank, 1st Constitution endeavors to remain on the cutting edge of technological advances.

“The company has a very sophisticated online banking system,” said Mangano, “strong cash management, excellent bill payment, mobile banking with mobile deposit, and a state-of-the-art website that allows customers to interact with us, wherever and whenever.

“From the facts we’ve gathered,” he continued, “it’s clear that the millennial population, as one segment of our business, needs to have a banking relationship, but is less apt to visit a branch office on a regular basis. This group wants the convenience of banking from their cell phone or other mobile device, and that’s exactly what we’re giving them. On our website, all customers have the option to open an account online and control every aspect of that account remotely.”

1st Constitution is also a concerned corporate citizen with long-standing ties to the communities it serves.

“We have 200 people who volunteer their time, resources, and financial support in a variety of ways,” Mangano said. “We support civic and charitable events and are committed to giving back to the communities from which we earn, because that’s what a community bank is all about.”

Mangano himself has served on the board of a number of institutions. He is a current member of the board of trustees of the Englewood Hospital and Medical Center, and on its system board, where he is chairman of the hospital’s Audit Committee. His past associations include The Boy Scouts of America, the Girl Scouts of the USA, and the Heart Fund.

Mangano has been president and chief executive officer of 1st Constitution for just over 20 years. He started his career with the Midlantic Corporation in the northern part of the state, spending 21 years with the company as a senior executive operating one of its primary subsidiaries. Before making the move to 1st Constitution, he was president and chief executive of Urban National Bank in Franklin Lakes, New Jersey, for three years. He has a bachelor of science degree from St. John’s University, where he majored in accounting.

When asked about the future, Mangano said he sees 1st Constitution continuing to thrive.

“I firmly believe there will always be a need for community banks,” he concluded. “Larger institutions have adopted a strategy that’s very different from ours. We know we can’t out-market or out-merchandise the larger institutions, but there’s an element of community banking that continues to be attractive. You can visit a branch where someone actually knows your name. You can trust that your branch office will be open and accessible…a place where you will receive only the best in personal service. And that’s exactly what you’ll find here.”

1st Constitution Bank

2650 Route 130 & Dey Road, Cranbury

609.655.4500 / 1stconstitution.com