A VETERAN TAX AND FINANCIAL PLANNING SHOP ENTERS ITS THIRD GENERATION ON STATEN ISLAND

BY ERIK SCHONING • PHOTOS BY ALEX BARRETO

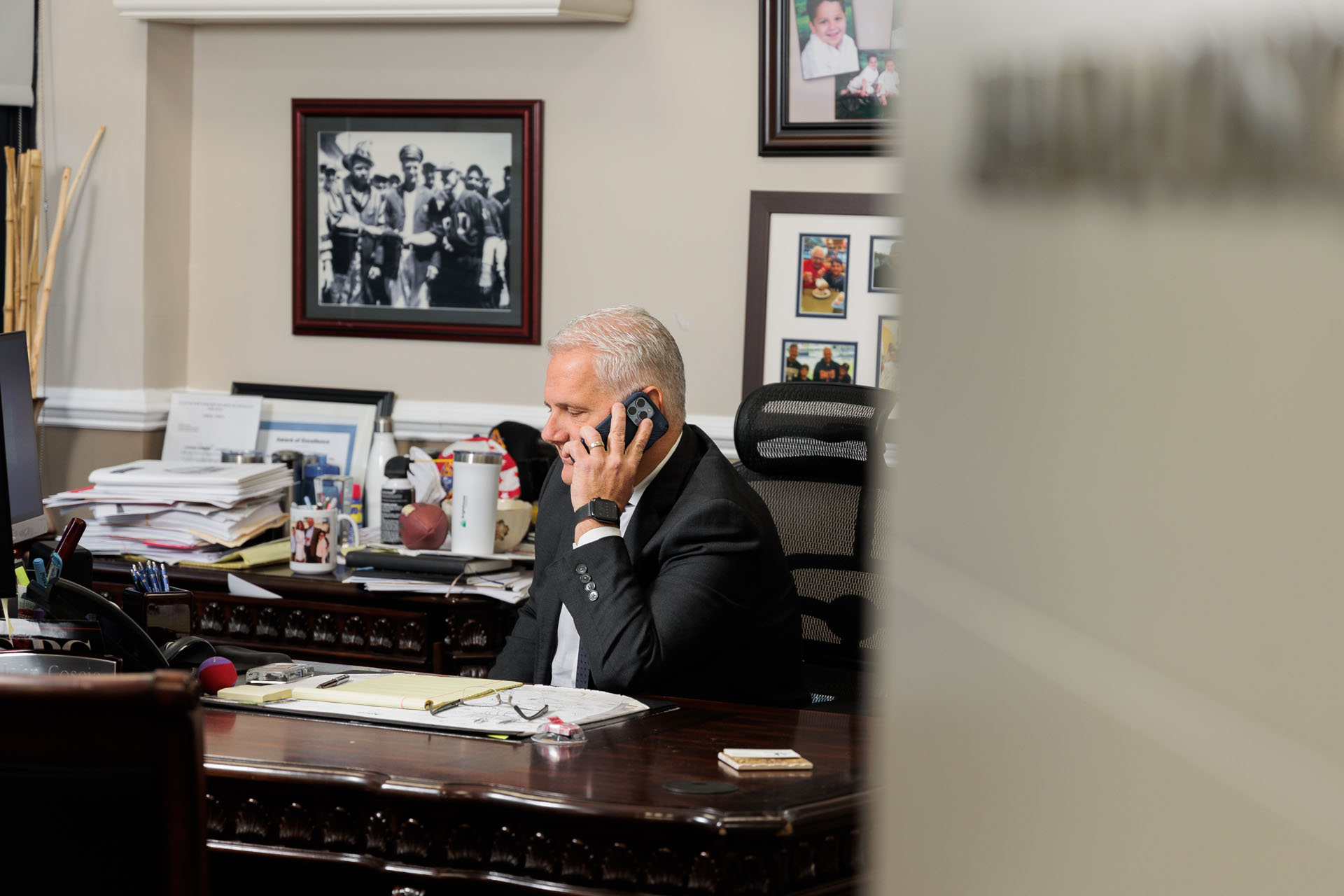

Every spring, a wave of tax preparation pop-ups sweeps over strip malls and empty storefronts throughout the borough. Like costume stores in October and tree stands in December, it’s a seasonal ritual, as consistent as a redbud’s first bloom. But for AJC Advisors, a dual-service tax prep and financial planning firm, year-round availability is a foundation of the business. The team wants their clients to know that no matter the time of year, they are available. Sixty years ago, AJC Tax was a tax-specific company steered by Angelo Coscia, father to current AJC helmsman John Coscia.

At the time, AJC specialized in tax returns for individuals and small corporations, and the young John wasn’t interested in getting into the tax game. He was drawn to finance. But after the elder Coscia sold the company in 1997 (he stayed on board to continue working with his clients), AJC’s services evolved into the unique combination of financial planning and tax prep that are offered today. John Coscia, fresh out of school, knew he had to get on board. “I was doubted by a lot of people in the company because I was young,” Coscia said. “But what they didn’t know is I had my father, who had clients that trusted him to no end. And I had a personality that could connect with those types of people.”

Building upon his father’s connections through his tax work, Coscia began managing those same clients’ wealth. It was a winning formula, and in the early 2000s he bought AJC back from its new owners, paying three times what his father received for the business. It was a risk, but Coscia was placing all his chips on the continued success of his formula. Though Angelo has since passed, today AJC is rooted in his legacy, one based on trust, attention to detail, and long-term relationships.

Unlike many competitors in the tax prep world, AJC doesn’t close its doors after April 15. Whether clients come to them purely for tax assistance or are looking to plan their retirement, there is an open-door ethos pervading the business that is distinctly old school. Though AJC has expanded from its Staten Island home to branch locations in Old Bridge and Matawan, the company’s staff, across the board, is seasoned, tenured, and in it for the long haul. “This office is unique in that most people know us on the island,” said Dawn Scotti, a financial assistant with AJC who has been with the company for 18 years. “Our goal is to make everybody feel comfortable when they come through the door. I think a lot of this is trust. Getting to know people and under-standing who they are comes with trust. You don’t trust somebody in one minute. You build relationships with the clients.”

For many people, taxes are simply a yearly burden, a chore to be knocked out every spring. But long-term financial planning, investing, wealth management, and retirement are big-picture concerns. AJC has positioned itself as a resource for clients in both regards. Today, Coscia is in the top one percent of financial advisors, an accolade garnered purely through word of mouth and referrals. (He and his team do no advertising or billboards for their financial planning services; again, they’re looking to develop real long-term relationships, not run a revolving door.) But Coscia’s mind is naturally forward thinking, and he’s already planning ahead for the future of AJC: his two children. “With my children getting into the business, my thinking is, there’s a lot of things that I’m falling behind on because of technology, because of the way the world is,” Coscia said. “I tell them: ‘I need you to come out of college in the next five years, six years, and bring that into our business.’ I also tell them that I’m not going anywhere until I can’t walk, see, or speak because this is still my thing and our family thing.”

Coscia said he’s excited to begin a long-term partnership with his two children, hinting at plans to one day expand AJC’s client base beyond the borders of the tri-state area. But in family businesses, a careful passing of the baton is always best, and he noted he looks forward to the opportunity for everybody to bring their individual skills to the table. In a landscape of automated banking, tax programs, and generic, one-size-fits-all financial advice, a tailored, client-centric experience is becoming increasingly scarce but remains exceedingly valuable. Coscia learned early in his finance career that face time with his clients would prove to be the best way to develop relation-ships, and in 2023, this belief hasn’t changed. AJC is still very much a family business, and Coscia includes all clients under that umbrella. As he tells it, this approach can make a world of difference. “In 2008, I had bought $300,000 in bonds for a client and they were down 40%,” Coscia recalled. “She came into the office and I said, ‘I’m so sorry, but they’re going to come back, you have to trust me.’ And they did eventually come back. But she said, ‘John, if I’m going to lose money, I want to lose it with you.’ I didn’t get it at first. So I went home to my wife, and my wife said, ‘John, that’s probably the best compliment anyone in the world could give you.”

AJC Advisors 1919 Hylan Blvd Suite #10 718.351.7538 / ajcadvisors.com